Tax Accountant Salary at Freelance, Self-Employed

Contents:

All employed individuals in the United States must pay the FICA tax, or the Federal Insurance Contribution Act in addition to federal and state income taxes. If you are a salaried or hourly employee, your employer covers half of these taxes for you. As a self employed individual, however, you will have to cover the full amount of these taxes on your own – 12.4% for Social Security and 2.9% for Medicare. And, since you aren’t getting taxes withheld every paycheck, you most likely will have to pay this 15.3% tax quarterly!

Student Loans And Taxes: 6 Strategies To Save You Money – Forbes

Student Loans And Taxes: 6 Strategies To Save You Money.

Posted: Wed, 12 Apr 2023 14:59:48 GMT [source]

Don’t let taxes scare you away from your dream of self employment. As a freelancer, you may want to start out as a sole trader and then set up a limited company as your business grows. As you’ll know, these setups have different responsibilities in terms of submitting your tax returns. The first step to starting a freelance accounting business is to take the Certified Public Accountant exam. As a CPA, you’ll have expertise in tax accounting, financial auditing, bookkeeping and other important topics that can benefit your clients.

Challenges of Being a Freelance Accountant

Create your free account today to get started with refreshingly simple bookkeeping software. Pandle includes financial reporting tools which automatically update each time you enter transactions into your bookkeeping. This means that your figures are always up to date, ready for you to use them in your Self Assessment.

Whether you decide to be your own business accountant or employ a bookkeeper, it is still important to understand the basics of accounting. Start recording all your costs and sales from the moment you set up your business, keeping receipts for everything you buy. Need an accountant to help you navigate the sometimes choppy financial waters of self-employment? Pearl Lemon Accountants can be that helping hand we just mentioned. We live in the era of technological innovations, and this has fostered the idea of self-employment in many industries. The accounting industry has many bookkeepers now looking for avenues to become independent and work on their terms.

LinkedIn is the main network for accountants and other business professionals. Follow these steps, and you’ll be reaping the benefits of being a self-employed accountant in no time. There are many different affordable and even free software’s that can help you become your own accountant or bookkeeper. If you would instead get a more established accountant, that is a good option also. Seeing that your potential accountant has had many clients or even still has a few can put you at ease. It seems like a huge risk, but with a little research, the risk of getting scammed is not as likely.

Getting Paid as a Freelancer: 5 Payment Methods…

ACCA allows you to offer a full range of accounting services, including tax, audits and financial advice to clients. Before you launch your business, make sure you have the right setup. A strong internet connection is essential, as is software for time tracking and workflow management, invoicing tools, and a payment processor. Don’t forget about insurance — consider professional indemnity, public liability, cyber, and contents insurance. The role is often confused with that of a bookkeeper, but they are quite different. A bookkeeper keeps track of day-to-day financial matters, monitoring cash flow, and maintaining records.

As with all freelancing jobs, you can set your own hours to fit around other commitments and make sure you have a good work-life balance. You can also pick your projects, focusing on the aspects of accountancy that interest you. And thanks to modern technology, you can work for clients anywhere in the world. For tech savvy businesses we offer online Cloud based accountancy solutions. You will need to pay your taxes, so make sure you budget for this to avoid a shock when it’s time to do your annual returns. It is possible to learn the necessary skills to manage your business’ finances, using the likes of online accounting courses, and basic bookkeeping courses.

Book a free call at time of your convenience

https://1investing.in/ typically make around £85k per year with a bonus of around £17,000 while working full-time. For a variety of reasons, working as a freelance accountant differs from working full-time in an accounting firm or internal department. Now you’re all set up, you’ll need the right accounting software.

There are not many disadvantages to someone who needs an accountant. As long as you have a reliable and credible accountant, there really should not be issues. A few reasons why someone may not need an accountant would include some of the following. Please put it in the hands of an accountant and let them do what they are trained to do—saving you a lot of time and headache. It is a good idea to make sure anyone you do business with is very open about their fee structure. On average, in the United States, you may pay around $30 an hour.

If you’re based in the U.S. you can read more about the taxes you’ll need to payhere. When you’re self-employed, you can write off certain expenses as tax deductions. This includes business-related hardware and software, traveling to visit clients, marketing costs, and a percentage of your household bills. When you file your taxes as a self employed or contract worker, you can deduct all of your business expenses, effectively lowering your total taxable income.

$1K Club Tests Clean Elections System – New Haven Independent

$1K Club Tests Clean Elections System.

Posted: Tue, 11 Apr 2023 19:50:00 GMT [source]

Hackers know that you, as an accountant, have lots of sensitive information and valuable data. The typical self-employed Certified Internal Auditor is hired by a business when they need an audit performed. With this certification, you’ll work with business owners to conduct audits and guide them through developing their financial procedures and controls. Still, starting a business isn’t all about dealing with the IRS and payroll taxes (although that’s a big part). You’ve overcome the hardest hurdle, but there are other steps involved as you go out into the world of self-employment. There are also many ways that accountants are needed in the self-employed world.

Do You Need an Accountant If Self Employed?

One of the best ways to do this is to open a business bank account. Preparing paystubs, invoices, 1099, w-2 forms and getting them in your email. That amounts to saving up more time with automation in accounting.

Starting your own venture or branching out as a freelancer is an exciting time that allows for a flexible schedule and greater control over your career. One of the hardest parts of managing a self employed career is understanding taxes. Since you no longer have an employer pulling taxes out of your paycheck, the responsibility falls on you.

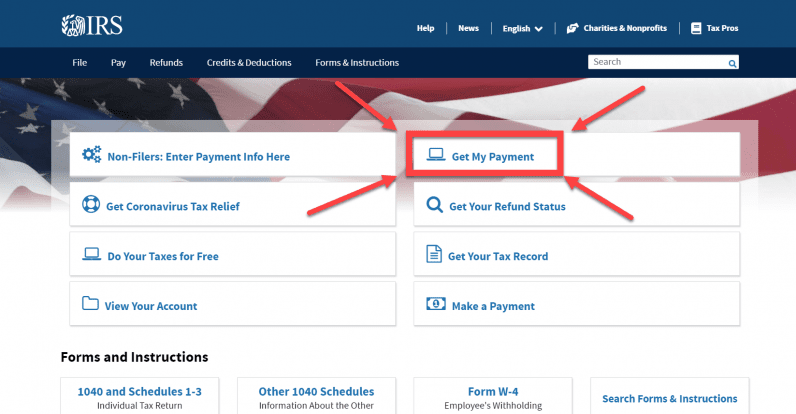

There is a fine like to walk here, however, as the IRS only allows certain things to be counted as business expenses. From the Schedule C form to quarterly tax deadlines, understanding self employment taxes can be a headache. With tax services from Paramount Tax, you can get organized and make your payments on time. We will help you plan and prepare for your quarterly payments so you never miss a deadline. Our accounting agents can help you understand what deductions you can take and how to provide adequate proof for them.

- Find someone compatible with your company to have a good and long-lasting relationship.

- When picking an accountant, there are some things to keep in mind.

- Contractors enjoy many advantages when outsourcing their tax management to an accountant.

- They act as an authority when it comes to the often complex requirements of the fiscal side of a business.

- With no set hours, it can be tempting to work around the clock when you’re trying to grow the business.

But if you don’t comply from day 1, it will become a lot more difficult later on without the help of an accountant. Self-employed persons must register by October 5th of the second tax year of their business. An accountant will help calculate your tax liability, detail the profitability of your business, and file your tax return. Second, registering as self-employed will enable you file your income tax return each tax year. Find out how much UK freelancers earn within marketing, tech and creative industries – and which freelance jobs pay the highest day rates.

An accountant can be a helpful guide on your journey as a small business owner. They act as an authority when it comes to the often complex requirements of the fiscal side of a business. This site contains free bookkeeping and accounting courses and is ideal for anyone looking to learn finance, bookkeeping or accounting.

florida income tax rate an accountant to provide a foundation and structure for your long-term business planning needs. Head to Selfgood and sign up for the ultimate self-employed business owner membership. You’ll get access to discounted rates and expert advisers ready to help you jumpstart your freelance accounting career. Because you’re dealing with someone else’s money while performing accounting services, it’s essential that you protect your assets. This can cause issues and potentially have you audited the next time you file your taxes.

Another service you can utilize is cloud-based accounting software. With this, you can access client financial data regardless of your locale and offer quick, quality service. Once you complete this, you’ll be able to sign off accounts for global organisations and call yourself a qualified accountant.

Bringing on an accountant to save time is likely to be cost-effective. It will free you up so you can focus on your work – work for which you are compensated and which will cover your accountancy fees. You can spend more time doing what you do best, whether it’s coding, developing, marketing, or engineering, by hiring a specialist self-employed accountant.

And though it is challenging, the type of accountant you choose to be will massively shape your experience. After all, freelance accountants are in demand, and you get the flexibility of setting your own hours and choosing which clients to work with. Cloud-based accounting software also lets you streamline tasks and work from anywhere. You’ll need to look after your own financial affairs and taxes, as well as other people’s. Keep organized records of your earnings and outgoings ready for tax season.

There are no comments